tax loss harvesting wash sale

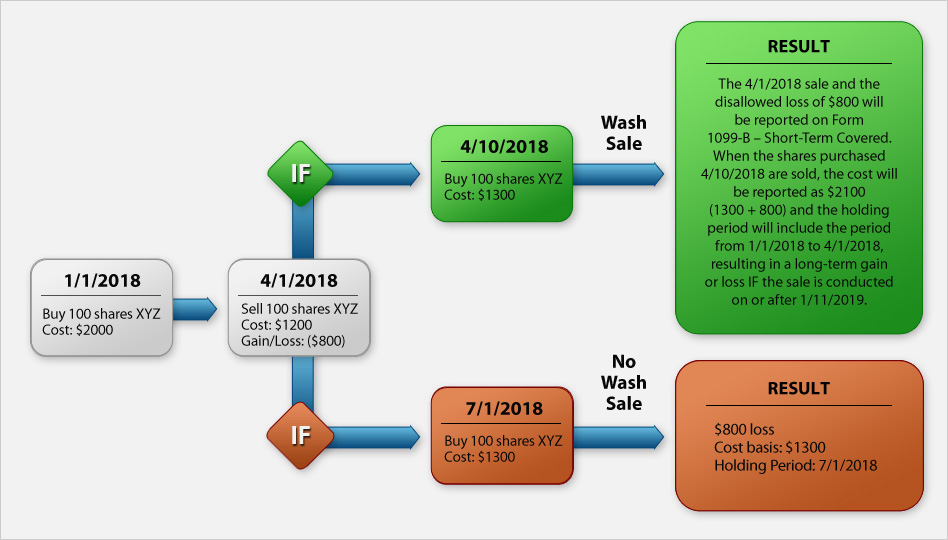

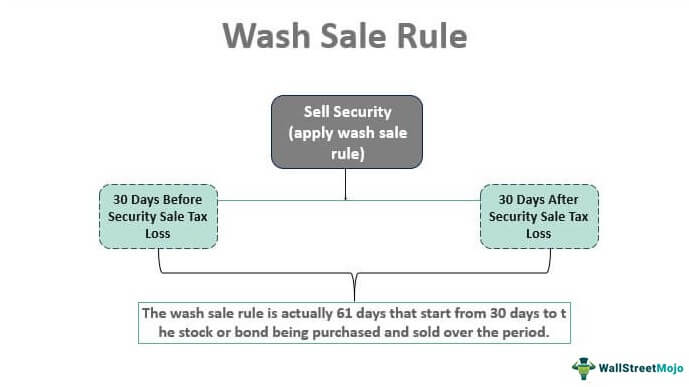

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical. Tax with harvesting 200000 - 130000.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

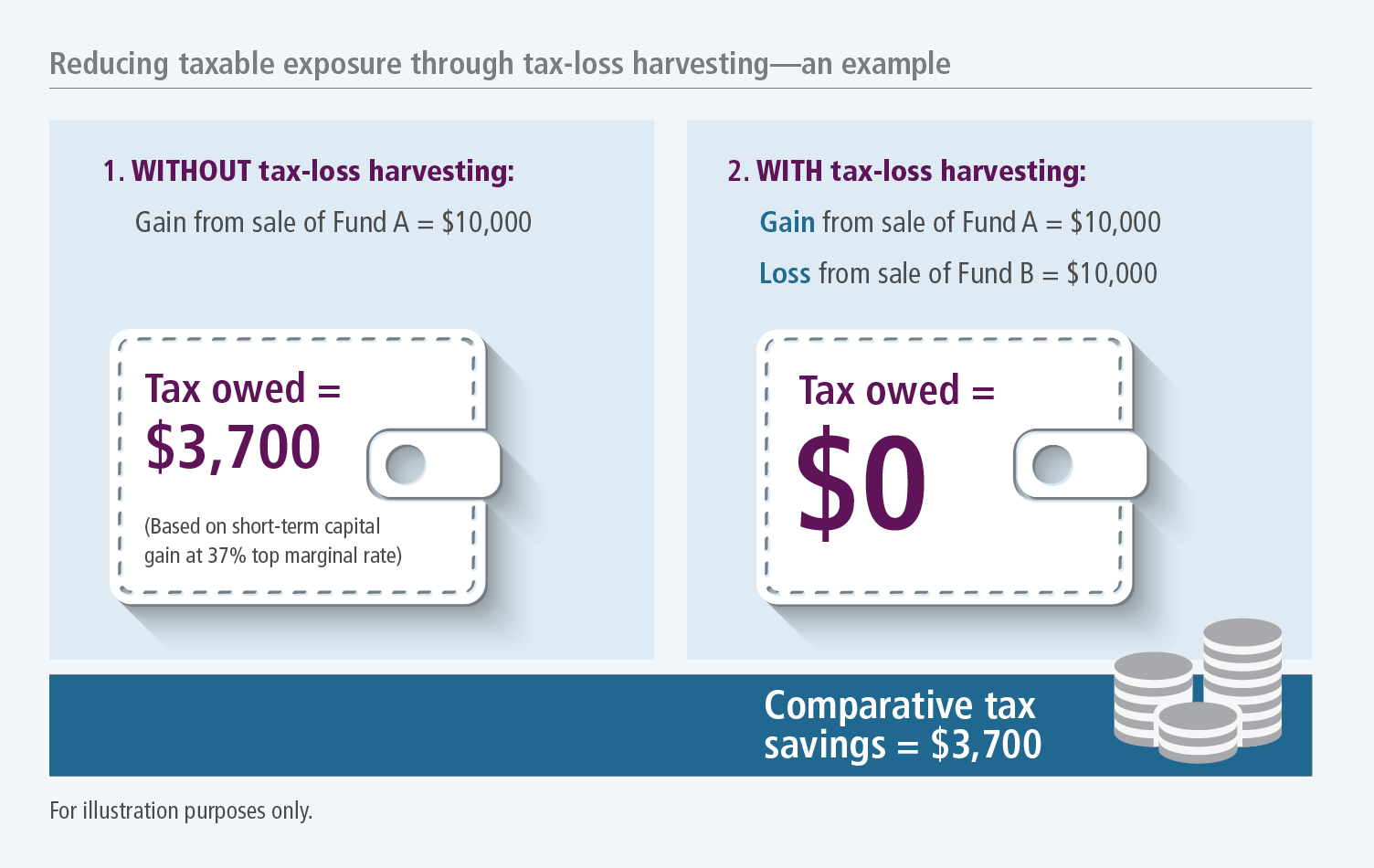

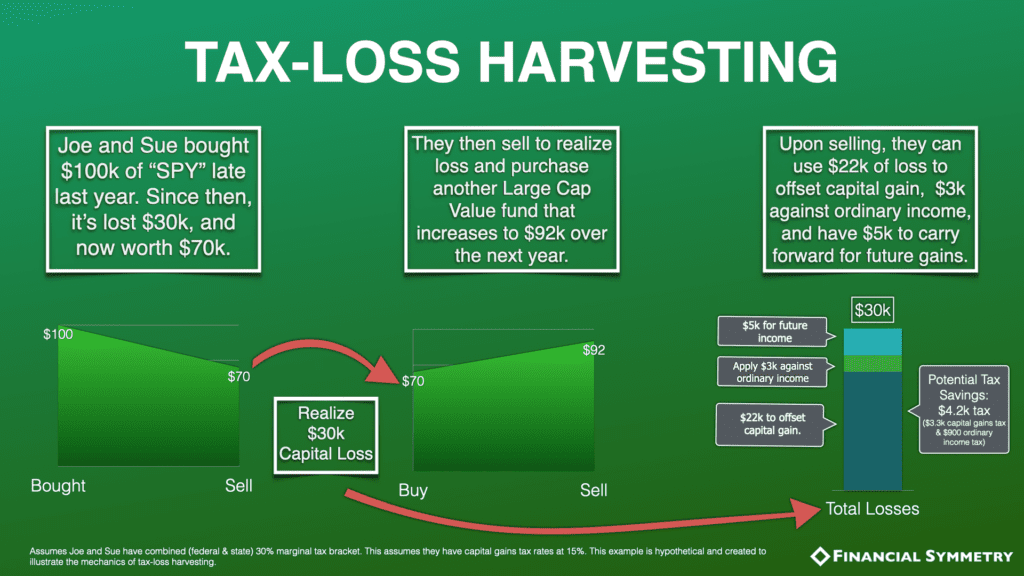

Tax loss harvesting is when you sell investments at a loss.

. Sell your Dogecoin at 08 for a loss. Investors looking to write off any capital losses need to beware of wash sales which can derail their attempt to claim a deduction during tax time. Because gains in retirement accounts are tax-deferred there is no tax impact until you.

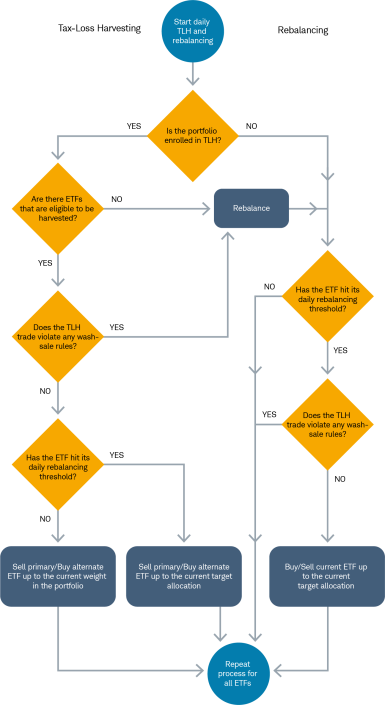

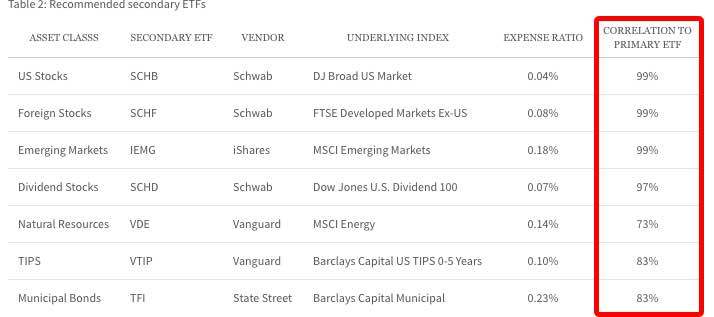

Those who wish to maintain their market exposure and asset allocations after the sale and still benefit from the tax losses must comply with the wash sale rule. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax. In May 2022 it dropped to around 08 a nearly 40 decrease and a loss of almost 4000.

Higher income earners can currently pay up to a 238 tax rate on realized long-term capital gains. Delay reinvesting the proceeds of a harvest for 30 days thereby ensuring that the repurchase will not trigger a wash sale. While its the easiest.

Understand the wash sale rule The IRS wash sale rule is in place to discourage transactions made purely for tax purposes. A wash sale is one of the key. Existing strategy Problem.

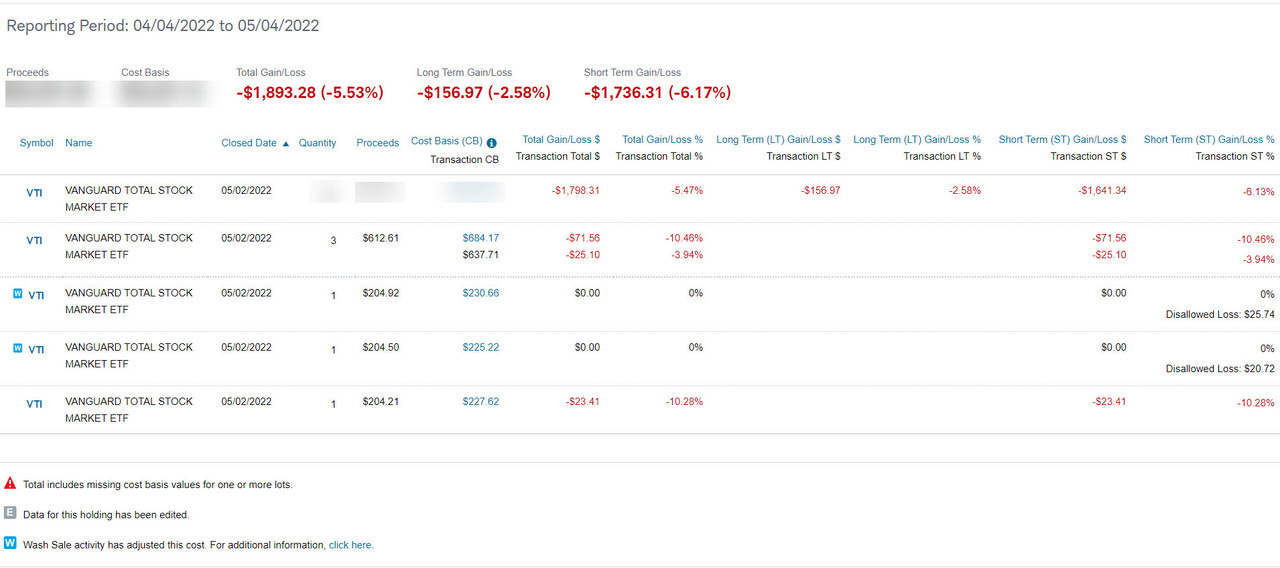

Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. One thing to note is that tax loss harvesting and wash sales apply only in taxable accounts. Tax Loss Harvesting and Wash Sale Rules.

If an investment is not expected to perform well or to decline in the future then that investment is usually sold to. 1 you realize that loss for tax purposes and then 2 you typically use the sale proceeds to buy a similar type of. An investment was originally purchased for 20000 but is now down 25 to 15000.

Assuming that there are current capital gains to offset that. Heres how investors can avoid violating wash sale rules when realizing tax losses In a down market you may consider tax-loss harvesting which can turn portfolio losses into. Therefore the tax basis of the Beta shares you acquire on December 19 2021 increases to 20200 12200 cost plus 8000 disallowed wash sale loss.

Harvesting generates a 5000 capital loss. The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim artificial losses in order to maximize. Capital gains distributions box 2a of a.

A wash sale occurs when you sell or trade stock or securities at. Offset realized capital gains. If the investor harvested losses by selling mutual funds B and C the sales would help to offset the gains and the tax owed would be.

When you use tax-loss harvesting you can use realized. Federal government allows investors. To take advantage of tax-loss harvesting you would first.

As others have said capital gains distributions box 2a of a 1099-DIV can be offset by either long or short term capital losses.

Rebalancing And Tax Loss Harvesting In Schwab Intelligent Portfolios Charles Schwab

Ep 12 Dec 12 2021 On Wash Sales And Tax Loss Harvesting Youtube

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

United States Why Does My Brokerage Show Adjusted Due To Previous Wash Sale Disallowed Loss When I Sold My Entire Position Personal Finance Money Stack Exchange

Tax Loss Harvesting What Does It Mean To Be Substantially Identical Biglaw Investor

Wash Sale Rule What Is It Irs Examples Exceptions

Tax Loss Harvesting Is A Strategy Used By Investors To Reduce Their Tax Burden By Taking Losses On One In Investing Chart Investment Financial Literacy Lessons

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

Wash Sale Rule What Is It Irs Examples Exceptions

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

Crypto Taxes Usa 2022 Update What You Should Know

Top 5 Tax Loss Harvesting Tips Physician On Fire

Understanding The Wash Sale Rule What It Is And How To Avoid It Kiplinger

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

How Investors Can Avoid Violating Wash Sale Rules When Realizing Tax Losses

The Irs Untold Secret Tax Loss Harvesting Seeking Alpha

What Advisors Need To Know About Tax Loss Harvesting

Us Tax Law And Cryptocurrency Part 2 Tax Loss Harvesting And Wash Sales R Cryptocurrency